Andromeda Sales and Distribution Private Limited is India’s leading distributor of loans. The company has its headquarters in Mumbai and branches in 1000+ cities in India. Andromeda also enjoys a strong agent network of more than 25,000 across the length and breadth of the country and an employee strength of over 3000 people. Through this network, it disburses loans and distributes other financial products such as credit cards, real estate and insurance. The organization was established in 1991 under the esteemed leadership of Mr. V Swaminathan.

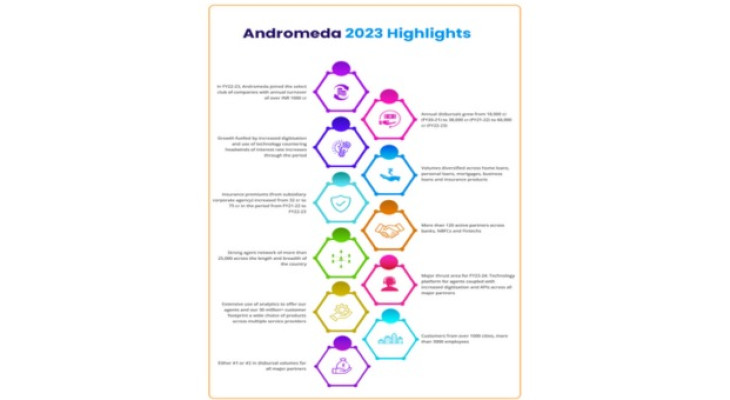

Major highlights of FY22-23

In the fiscal year 22-23, Andromeda achieved a significant milestone with an annual turnover of over INR 1000 cr. In addition to this remarkable achievement, the company’s annual loan disbursals grew from INR 18,000 cr in FY20-21 to INR 38,000 cr in FY21-22 and further to INR 60,000 cr in FY22-23. More so, the company’s insurance premiums, from its subsidiary corporate agency, rose from INR 32 cr to INR 75 cr in the period from FY21-22 to FY22-23.

This growth was fueled by increased digitization and the use of technology, which helped the company counter the headwinds of interest rate increases through the period. Despite the uncertainty in the lending industry, the organization was equipped with the requisite digital skillsets and cultural alignment that helped drive sales. This has helped Andromeda streamline its operations, reduce costs and improve customer experience. At the same time, embracing digital technology has helped the company remain competitive in an increasingly crowded market.

Other factors driving Andromeda’s growth

Its diversified financial product offering also has played a significant role in this success. Andromeda’s volumes are diversified across home loans, personal loans, mortgages, business loans and insurance products.

Moreover, the organization has more than 120 active partners across banks, NBFCs and fintech companies across the country. It is considered amongst the ‘top 3 most-preferred channel partners for loans’. And particularly in FY22-23, it led disbursal volumes for all major partners. Andromeda’s growth is a reflection of the long-standing associations with its partners, such as HDFC Bank, Tata Capital, Future Generali and MoneyWide.

The company’s success is a testament to the extensive usage of data and analytics in its business models. This entails offering its agents and 30 million+ customer footprint a wide range of products across multiple service providers. The sole purpose of this is to create a robust communication strategy between its partners and customers, which inevitably contributes to its annual turnovers.

Major thrust area for FY23-24

In the new fiscal year, Andromeda’s major area of focus is on developing a technology platform for agents to earn and sell seamlessly. It will be coupled with increased digitization and Application Programming Interfaces (APIs) across all major partners. The organization is building a digital infrastructure that will serve it well in the coming years.

The initiative is a reflection of the broader trends in the Indian lending ecosystem. It has become imperative to adapt to the trends and become more data-rich, digitally savvy and process-oriented. Given the fact that customers are looking for innovative and smooth experiences in all online transactions, investing in cutting-edge technology is the need of the hour. Besides, the digital transformation also adds value to Andromeda’s rich legacy of three decades.

Wrapping up

Andromeda’s achievement of an annual turnover of over INR 1000 cr is a major milestone. While adding branches and people to sustain its growth momentum will be paramount, the company aspires to integrate the best practices in digital and technology to maintain its growth in the coming years and consolidate its stance as India’s largest loan distributor.

Advertisement